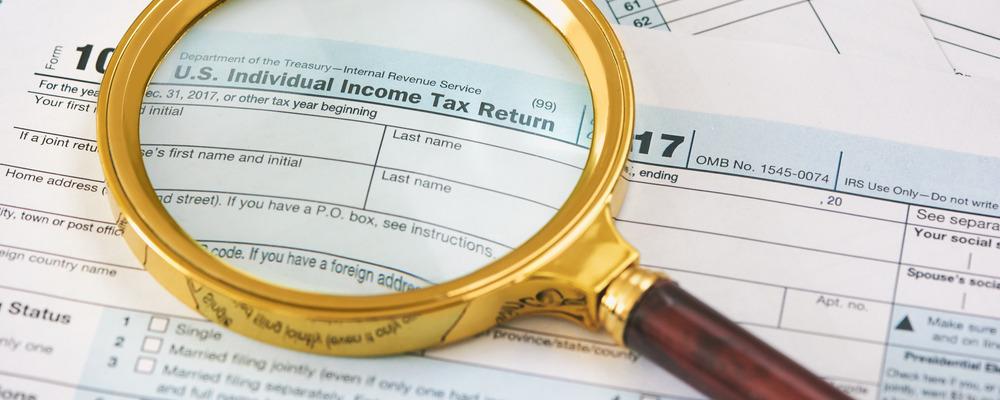

Planning is the key to successfully and legally reducing your tax liability. We go beyond tax compliance and proactively recommend tax saving strategies to maximize your after-tax income.

Planning is the key to successfully and legally reducing your tax liability. We go beyond tax compliance and proactively recommend tax saving strategies to maximize your after-tax income.

We make it a priority to enhance our mastery of the current tax law, complex tax code, and new tax regulations through continuous tax education.

Businesses and individuals pay the lowest amount of taxes allowable by law because we continually look for ways to minimize your taxes throughout the year, not just at the end of the year.

DeVine & Associates, LLC provides the following tax planning services:

- Quarterly Estimate Review

- Automatic Quarterly Estimate Payments

- Year-End Tax Planning

- Tax Transaction Projections

- W-4 Withholding Preparation

- Tax Issues Resolution

Whatever your tax needs…